1,2 percent GPM

We are beneficiaries – according to the Law on Charity and Support of the Republic of Lithuania, we have the right to receive support thanks to you. We kindly invite you to donate a part of the personal income tax you have already paid to us.

Deadline for support: every year from the beginning of the year to 1 May.

1,2 % GPM support methods:

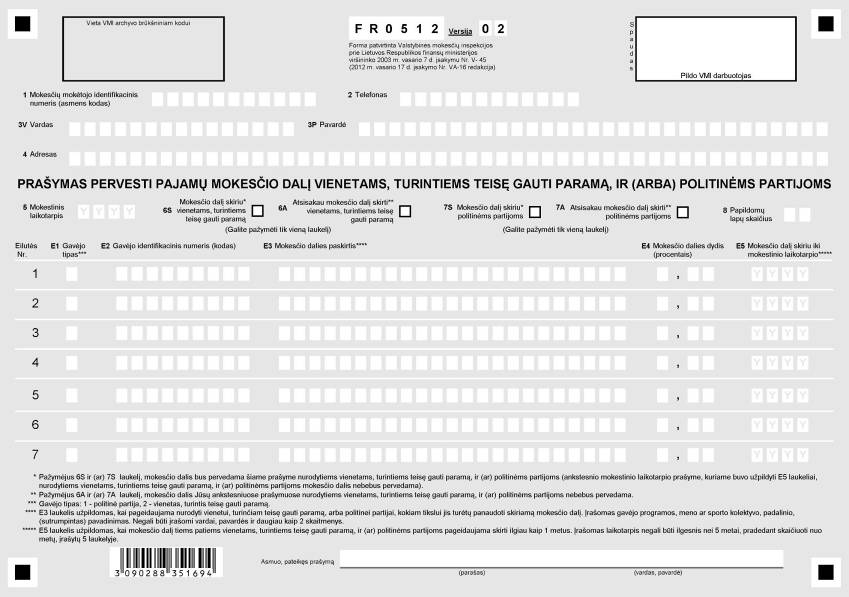

Method 1. Fill in the required form (you can download it here)

⦁ Complete form FR0512 v.2 in capital letters only, leaving blank lines blank.

1 – Enter your personal code

2 – enter your phone number (code and number)

3V – enter your name

3P – Enter your last name

4 – enter your place of residence (city, street, house number, apartment number)

5 – enter the year of filling.

The item of the tax period shall be the year of the previous tax period.

6S – mark the box with an X.

E1 – indicate the beneficiary’s line number

E2 – enter the company code of the beneficiary: 191869255

E3 – enter the full name of the beneficiary: Lithuanian Association of People with Spinal Cord Injuries

E4 – enter the part of the income tax requested to be transferred: 1.2%

E5 – enter how many years you would like to pay 2% personal income tax to us.

The period can be up to 5 years. If you want to support our organization all year round, enter – 2026

⦁ Sign and write your name at the bottom of the form.

⦁ After filling in the application, send the completed form to the address: Declaration Management Division Druskininkai CSTI. Neravų st. 8, Neravų village Druskininkai LT – 66402

⦁ The envelope must be signed (signature on the sealed line) in such a way that it is not possible to open the envelope without damaging the integrity of the signature.

Method 2. Submit the completed form directly to the tax administrator in your city

⦁ Print Form FR0512

⦁ Fill in the form indicating your data and the details of the Lithuanian Association of People with Spinal Injuries.

⦁ Take it to your city STI (http://www.vmi.lt/)

Method 3. Submit electronically via EDS.

1. Log in to your electronic banking via the Electronic Declaration System website (http://deklaravimas.vmi.lt/lt/Pradinis_Prisijungimo_puslapis/Prisijungimasperisorinessistemas.aspx);

2. Select the Electronic Declaration System (EDS) in which you will already be registered (data is taken from the bank);

3. Select the “Grant Support” section on the right side of the window;

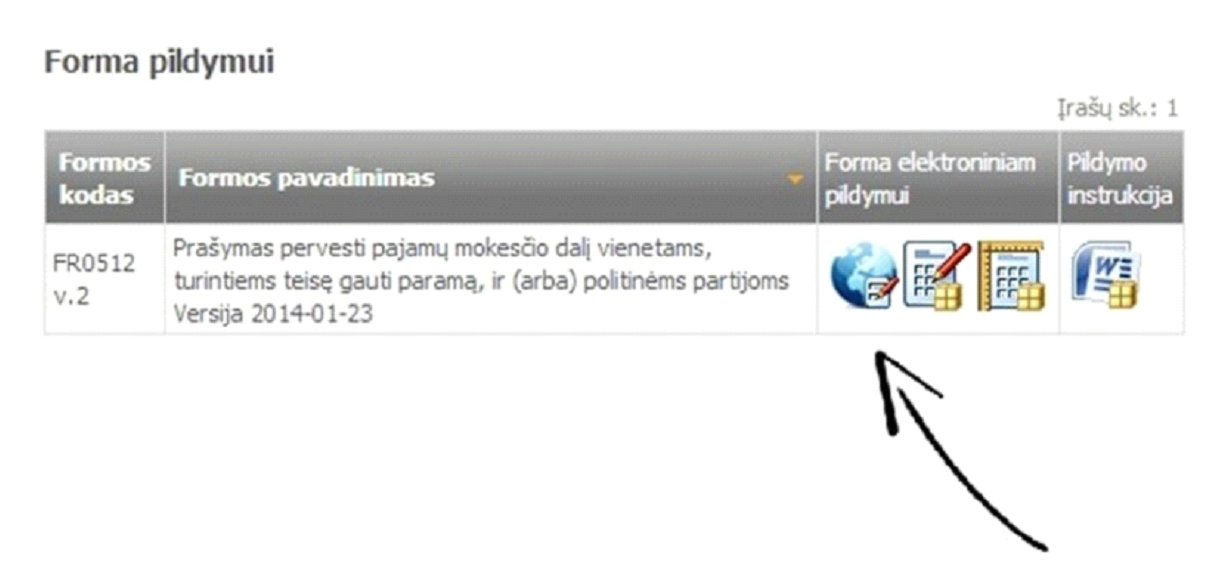

4. At the bottom of the page you will see FR0512 “Form to fill in”. Select the blue icon: “fill in the form directly on the portal”

5. Fill out and submit the form.